lakewood sales tax filing

Receive Lakewood City News Updates Email Constant Contact Use. Lakewood OH 44107 216 521-7580.

U S Tax Refunds Down Nearly 9 Percent Vs Year Ago Irs Data Irs Tax Forms Tax Return Irs Forms

Taxpayers who wish to pay their quarterly estimated tax bills may do so using this service.

. 800 AM to 430 PM. The City of Lakewood requires persons who expect to owe more than 20000 in tax for the current filing year to make quarterly estimated tax payments. What is the sales tax rate in Lakewood New Jersey.

Annual returns are due January 20. Business Licensing Tax. The Finance Director may permit businesses whose monthly collected tax is less than three hundred dollars 300 to make returns and payments on a quarterly basis.

Sales Use Tax. The 8 sales tax rate in Lakewood consists of 4 New York state sales tax and 4 Chautauqua County sales taxThere is no applicable city tax or special tax. Sales Use Tax Learn more about transactions subject to Lakewood salesuse tax.

Historical Sales Tax Rates for Lakewood 2022 2021 2020. The 2010 tax rate for Lakewood Township is 2308 for every 10000 of assessed value. Get Involved - Stay Informed.

Under 300 per month. 800 AM to 430 PM. The 59583 sales tax rate in Lakewood consists of 5125 New Mexico state sales tax and 08333 Eddy County sales tax.

Sales and use tax returns are due on the 20th day of each month following the end of the filing period. CHICAGO May 10 2022--CityBase announces a new engagement with the Township of Lakewood NJ to introduce new kiosk bill. FILE AND PAY SALES AND USE TAX ONLINE - 2018 and later.

Re Taxes Small Business Tax Tax Time Business Tax Your Taxes Then And Now Visual Ly Infographic Infographic Design Finance Infographic Sales Use Tax City Of Lakewood Business Licensing Tax City Of Lakewood. The minimum combined 2022 sales tax rate for Lakewood New Jersey is. This is the total of state county and city sales tax rates.

File your state income taxes online. This is the total of state county and city sales tax rates. Returns can be accessed online at Lakewood.

What is the sales tax rate in Lakewood California. We register file read lettersemails resolve notices. Give feedback about projects and issues.

To figure out the taxes on a piece of property with a total assessment of 23377808 the average assessment for a residential property in Lakewood Township in 2011 you would divide 23378808 by 100 233788 and multiply that figure by the tax rate 2. 4 rows Sales tax is a transaction tax that is collected and remitted by a retailer. The minimum combined 2022 sales tax rate for Lakewood New York is.

Sales tax returns may be filed quarterly. Lakewoods approach to economic development is as unique as our community. 15 or less per month.

Lakewood Business Pro Manage your tax account online - file and pay returns update account information and correspond with the Lakewood Revenue Division. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. The County sales tax rate is.

The Sales and Use Tax Return is generally due on the 20th of the month. Filing of Sales Tax Returns Sales tax returns and payments shall be made monthly before the twentieth 20th day of the following month. Sales Tax The Local Sales and Use Tax Rate of 100.

Get the latest city information. The California sales tax rate is currently. License My Business Determine if your business needs to be licensed with the City and apply online.

Did South Dakota v. Payment Taxes Recent News. Taxpayers may also check estimates file their current years tax return and upload digital copies of their tax documents such as W-2s or Federal 1040 for both the current year and prior years.

Did South Dakota v. There is no applicable city tax or special tax. License file and pay returns for your business.

For more information on home occupation requirements contact the city directly. The Lakewood sales tax rate is. Historic Preservation Tax 2009 - Ordinance No.

Sales and Use Tax 2011 - Ordinance No. Sales and Use Tax 2002 - Ordinance No. ATTACH all appropriate W-2s 1099s and other Schedules.

Manage My BusinessTax Account password required Online Payment Options. The County sales tax rate is. Lakewood City Council Sets Deadline for Ward 4 Council Seat Applications May 06 2022.

Consumer Use Tax 2011 - Ordinance No. Filing frequency is determined by the amount of sales tax collected monthly. For tax rates in other cities see New Mexico sales taxes by city and county.

16 2020 per Resolution 2020-14. Pay water sewer and stormwater utility bills traffic tickets and business tax returns. 20 May 2022 Older Adult.

Effective July 1 2021 local sales and use tax within Pierce County except for Tacoma will increase one-tenth of one percent 001. Lakewood is a. You can print a 59583 sales tax table here.

Learn more about sales and use tax public improvement fees and find resources and publications. The New Jersey sales tax rate is currently. Sales tax returns may be filed annually.

Taxes Fees in Lakewood Fee Schedule 2021 Fee Schedule as adopted by City Council on Nov. The County sales tax rate is. The Small Glories come to Lakewood for a cant miss night of Americana and Canadian roots music.

We focus on facilitating appropriate real estate development and. The New York sales tax rate is currently. Estimates for the current year are billed quarterly with the exception of the first quarterwhich is due to be paid with your tax return by the April filing deadline.

Lakewood sales tax online filing Wednesday February 23 2022 Edit. This is the total of state county and city sales tax rates. The Lakewood sales tax rate is.

If your business is in a residence within the city you must comply with Lakewood Municipal Code 18A70250. The minimum combined 2022 sales tax rate for Lakewood California is. The Lakewood sales tax rate is.

Ad Sales Tax Experts manage State compliance and bureaucracy on your behalf in all states. Businesses that pay more than 75000 per year in state sales tax.

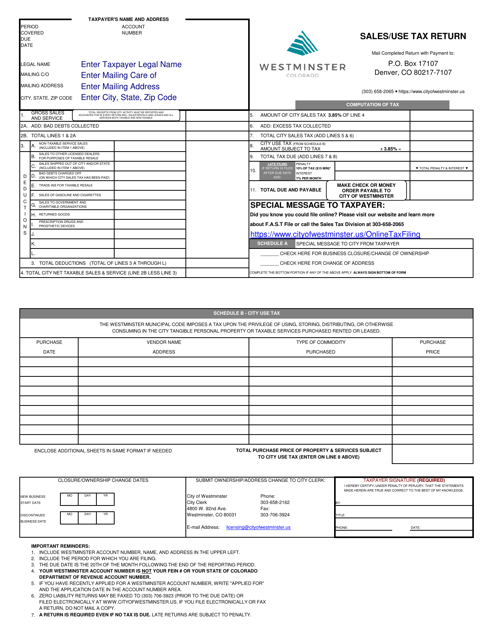

City Of Westminster Colorado Sales Use Tax Return Download Fillable Pdf Templateroller

Ways To File Taxes For Free With H R Block H R Block Newsroom

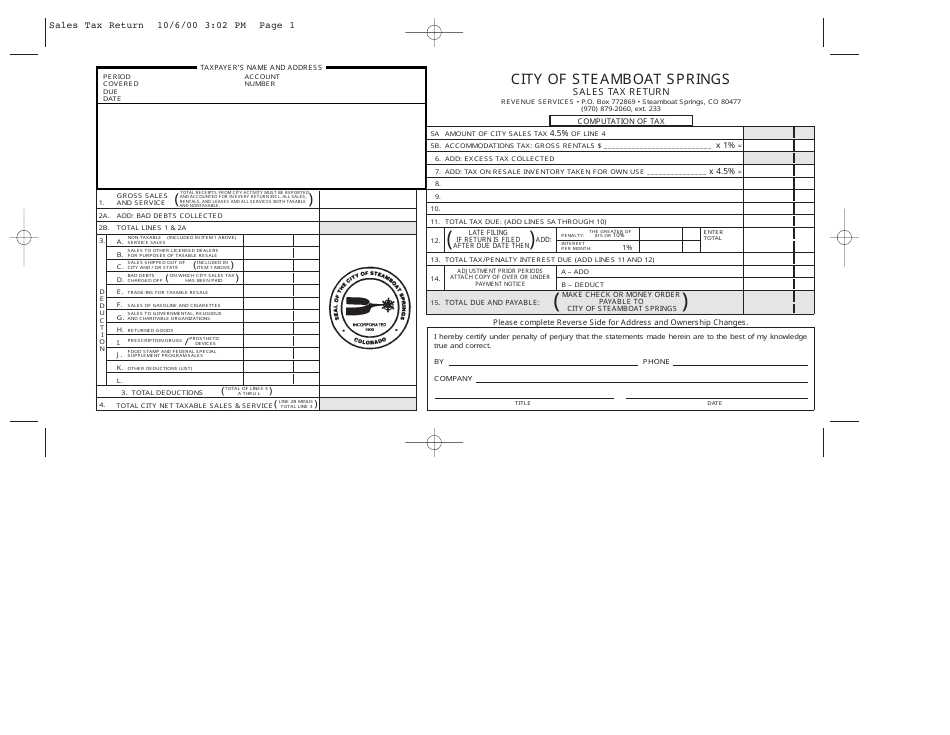

City Of Steamboat Springs Colorado Sales Tax Return Form Download Printable Pdf Templateroller

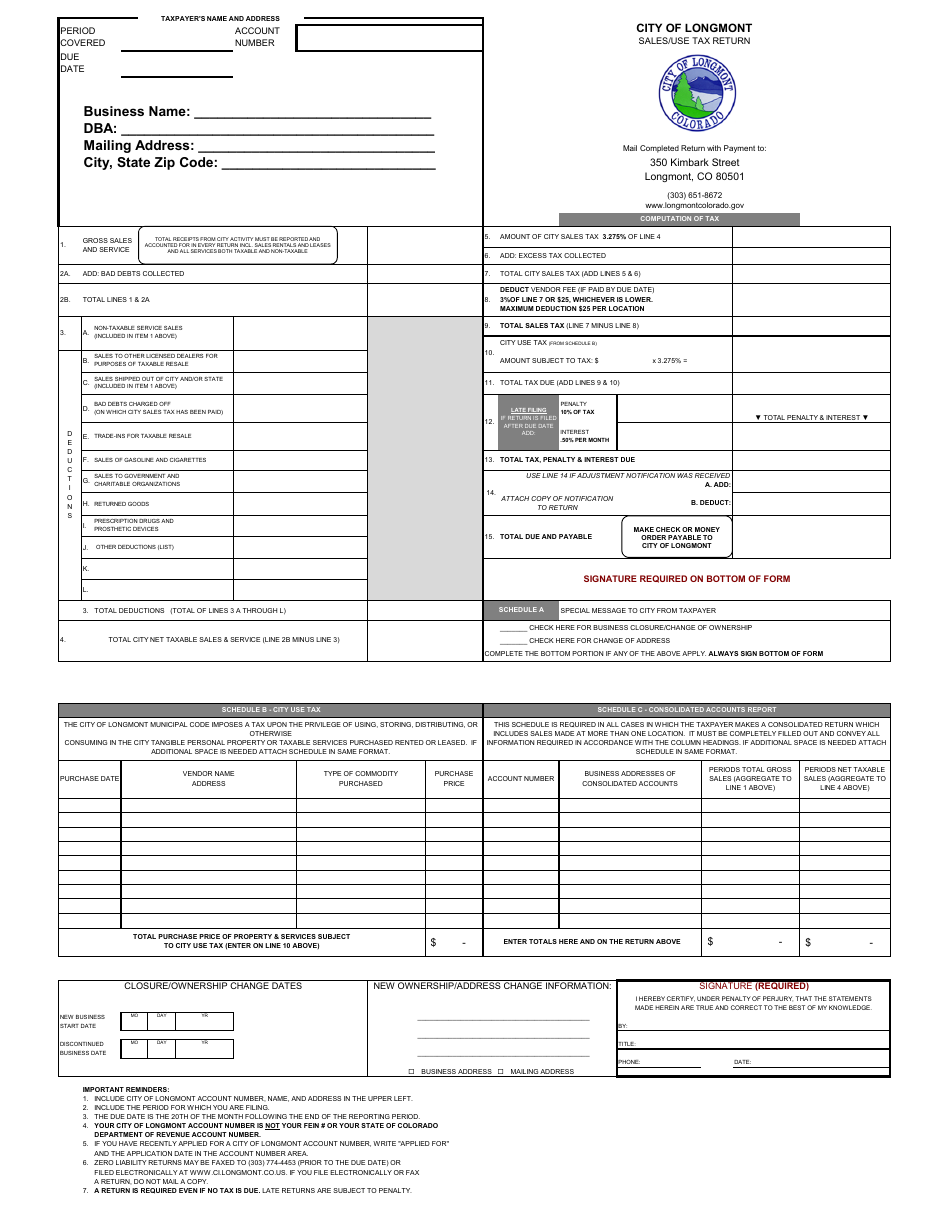

City Of Longmont Colorado Sales Use Tax Return Form Download Printable Pdf Templateroller

The Smarter Way To File Your Taxes Infographic Filing Taxes Tax Refund Infographic

Business Licensing Tax City Of Lakewood

Where Do My Taxes Go H R Block Business Leader Consumer Math Financial Planning

Pin By Experto Tax Service On Experto Tax Service Small Business Online Small Business Online Business

Will Ohio S Tax Filing Deadline Be Postponed To May 17 To Match The New Irs Deadline Cleveland Com

Strange Audits Visual Ly Tax Services Infographic Audit

Filing Your Tax Return Don T Forget These Credits Deductions National Globalnews Ca Small Business Tax Business Tax Bookkeeping Business

City Of Lakewood Colorado Sales And Use Tax Return Form Download Fillable Pdf Templateroller

File Sales Tax Online Department Of Revenue Taxation

File Sales Tax Online Department Of Revenue Taxation

Understanding Income Taxes Visual Ly Income Tax Business Tax Tax Services

Business Licensing Tax City Of Lakewood

Sic Code 7291 Tax Return Preparation Services