lake county sales tax ohio

Click here for a larger sales tax map or here for a sales tax table. The Lake County Sales Tax is 15.

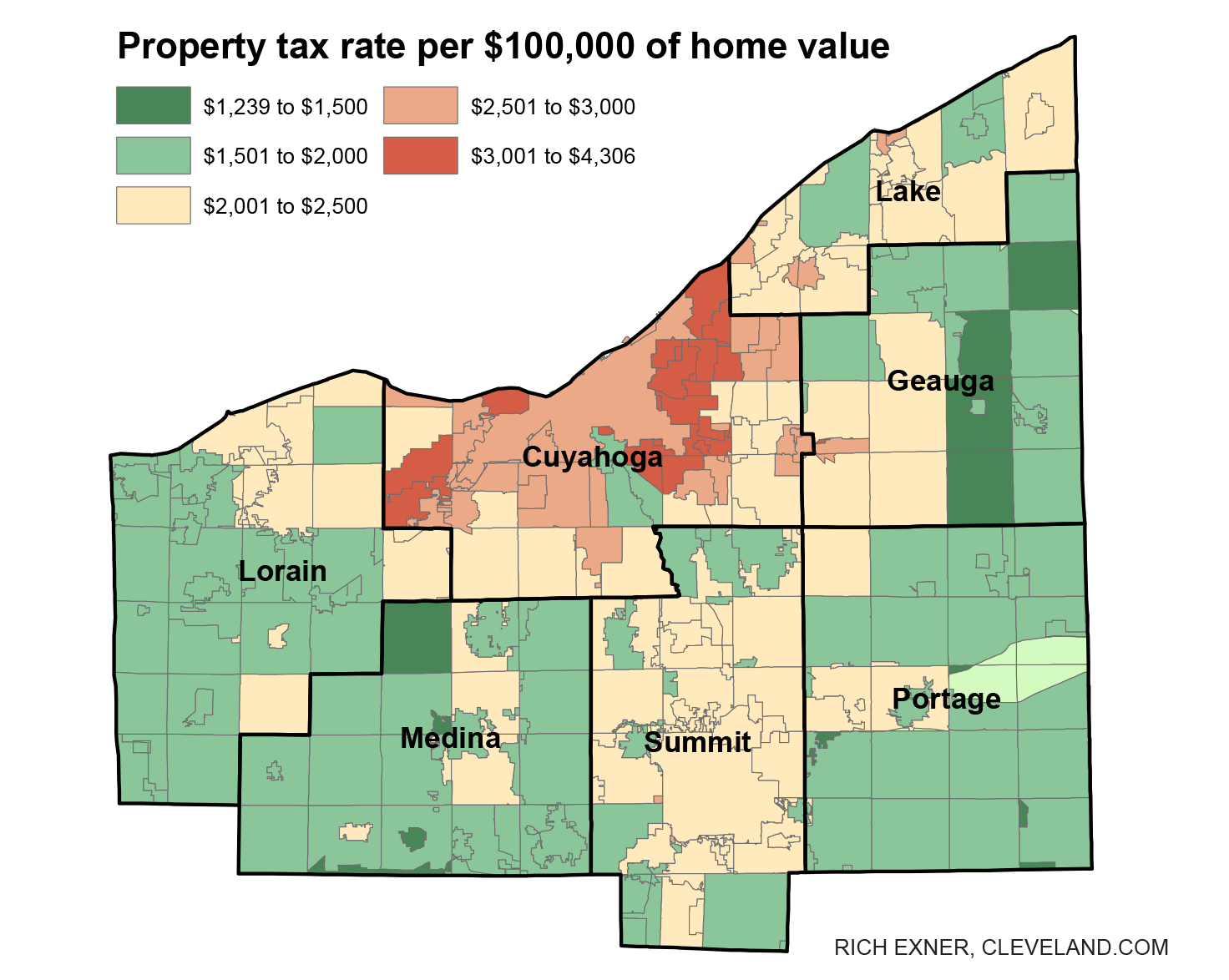

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

2020 rates included for use while preparing your income tax deduction.

. Sales tax in Lake County Ohio is currently 7. Ohio sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Ohio collects a 5 75 state sales tax rate on the purchase of all vehicles.

The Ohio state sales tax rate is currently 575. History of tax lien sales in ohio house bill 371 introduced on april 8 1997 and signed into law on november 26 1997 allowed. This is the total of state and county sales tax rates.

Help us make this site better by reporting errors. 1151 rows Ohio Sales Tax. Some cities and local governments in Lake County collect additional local sales taxes which can be as high as 075.

Fast Easy Tax Solutions. If you need access to a database of all Ohio local sales tax rates visit the sales tax data page. The Ohio state sales tax rate is currently.

These buyers bid for an interest rate on the taxes owed and the right to collect back that. Ohio has state sales tax of 575 and allows local governments to collect a local option sales tax of up to 225. The 2018 united states supreme court decision in south dakota v.

Auditor land bankstate of ohio. The Geauga County sales tax rate is 1. Lake county land reutilization corporation.

The minimum combined 2022 sales tax rate for Geauga County Ohio is 675. Skip to Sidebar Nav. However Section 32313 of the Ohio Revised Code provides that the property owner is responsible for.

The base state sales tax rate in Ohio is 575. Lake county land reutilization corporation. The December 2020 total local sales tax rate was also 7250.

Lake County OH currently has 509 tax liens available as of May 2. A county-wide sales tax rate of 15 is applicable to localities in Lake County in addition to the 575 Ohio sales tax. If this rate has been updated locally please contact us and we will update the sales tax rate for Lake County Ohio.

Ad Find Out Sales Tax Rates For Free. The Lake County Sales Tax is collected by the merchant on all qualifying sales made within Lake County. Lake county collects a 1 25 local sales.

105 Main Street Painesville OH 44077 1-800-899-5253. Every effort is made to see that you receive your tax bills. Find your Ohio combined state and local tax rate.

The current total local sales tax rate in Lake County OH is 7250. Generally the minimum bid at an lake county tax deeds sale is the amount of back taxes owed plus interest as well as any and all costs associated with selling the property. The latest sales tax rates for cities in Ohio OH state.

Rates include state county and city taxes. Auditor land bankstate of ohio. Lake county tax rate 7 25 previously 7 00 note.

Lake County in Ohio has a tax rate of 7 for 2022 this includes the Ohio Sales Tax Rate of 575 and Local Sales Tax Rates in Lake County totaling 125. Lake county ohio treasurer site. The states sales and use tax rate is currently 575.

Or visit our Ohio sales tax calculator to lookup local rates by zip code. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Lake County OH at tax lien auctions or online distressed asset sales. The Lake County Ohio sales tax is 700 consisting of 575 Ohio state sales tax and 125 Lake County local sales taxesThe local sales tax consists of a 125 county sales tax.

Summary of Lake County Ohio Tax Foreclosure Laws. Lake county land reutilization. 105 Main Street Painesville OH 44077 1-800-899-5253.

Average Sales Tax With Local. Lake hospital foundation inc. The 2018 United States Supreme Court decision in South Dakota v.

The sales and use tax rate for Paulding County 63 will increase from 675 to 725 effective January 1. F m company. Has impacted many state nexus laws and sales tax collection requirements.

2022 1st Quarter Rate Change. Lake hospital foundation inc. Lake 100 050 725 Wood 100 675 Lawrence 150 725 Wyandot 150 725 Note.

The sales and use tax rate for Lucas County 48 will increase from 725 to 775 effective April 1 2022. The sales tax rate for Lake County was updated for the 2020 tax year this is the current sales tax rate we are using in the Lake County Ohio Sales Tax Comparison Calculator for 202223. Local tax rates in Ohio range from 0 to 225 making the sales tax range in Ohio 575 to 8.

Has impacted many state nexus laws and sales. Lake County Ohio Local County Sites. Lake county land reutilization corporation.

Lake county ohio sales tax on cars. The 2018 United States Supreme Court decision in South Dakota v. Always consult your local government tax offices for the latest official city county and state tax rates.

Automating sales tax compliance can help your business keep compliant with changing. 112991 2021 Terms of Use Copyright 2020. Population 230149 2019 Parcels.

The Lake County sales tax rate is. To review the rules in Ohio visit our state-by-state guide. 2022 Ohio Sales Tax By County Ohio has 1424.

Ashtabula County Cuyahoga County Geauga County. Lake County Ohio. THE LAKE COUNTY TREASURERS OFFICE IS OPEN TO THE GENERAL PUBLIC.

There are a total of 578 local tax jurisdictions across.

These Cuyahoga County Places Have Ohio S 6 Highest Property Tax Rates That S Rich Recap Cleveland Com

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Lake Homes At Twin Creeks At Tims Ford Lake In Tennessee Tennessee Travel Day Trips Lake Life

Home County Auditor Website Madison County Ohio

Vintage Ohio License Plate Green White 1974 Free Shipping Etsy License Plate Garage Decor Man Cave Bar

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Find Out Where Your City Or Township Ranks For Property Tax Rates In Greater Cleveland Akron Area Cleveland Com

Ohio Sales Tax Guide For Businesses

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Haves And Have Nots County Property Taxes Provided 2 5 Billion In Local Health And Social Service Funding But It Was Unevenly Distributed The Center For Community Solutions

Greater Cleveland S Wide Spread In Property Tax Rates See Where Your Community Ranks Cleveland Com

Compare New Property Tax Rates In Greater Cleveland Akron Part Of South Euclid Now Has Top Rate In Northeast Ohio Cleveland Com