kentucky transfer tax calculator

Some areas do not have a county or local transfer tax rate. The median property tax on a 12940000 house is 135870 in the United States.

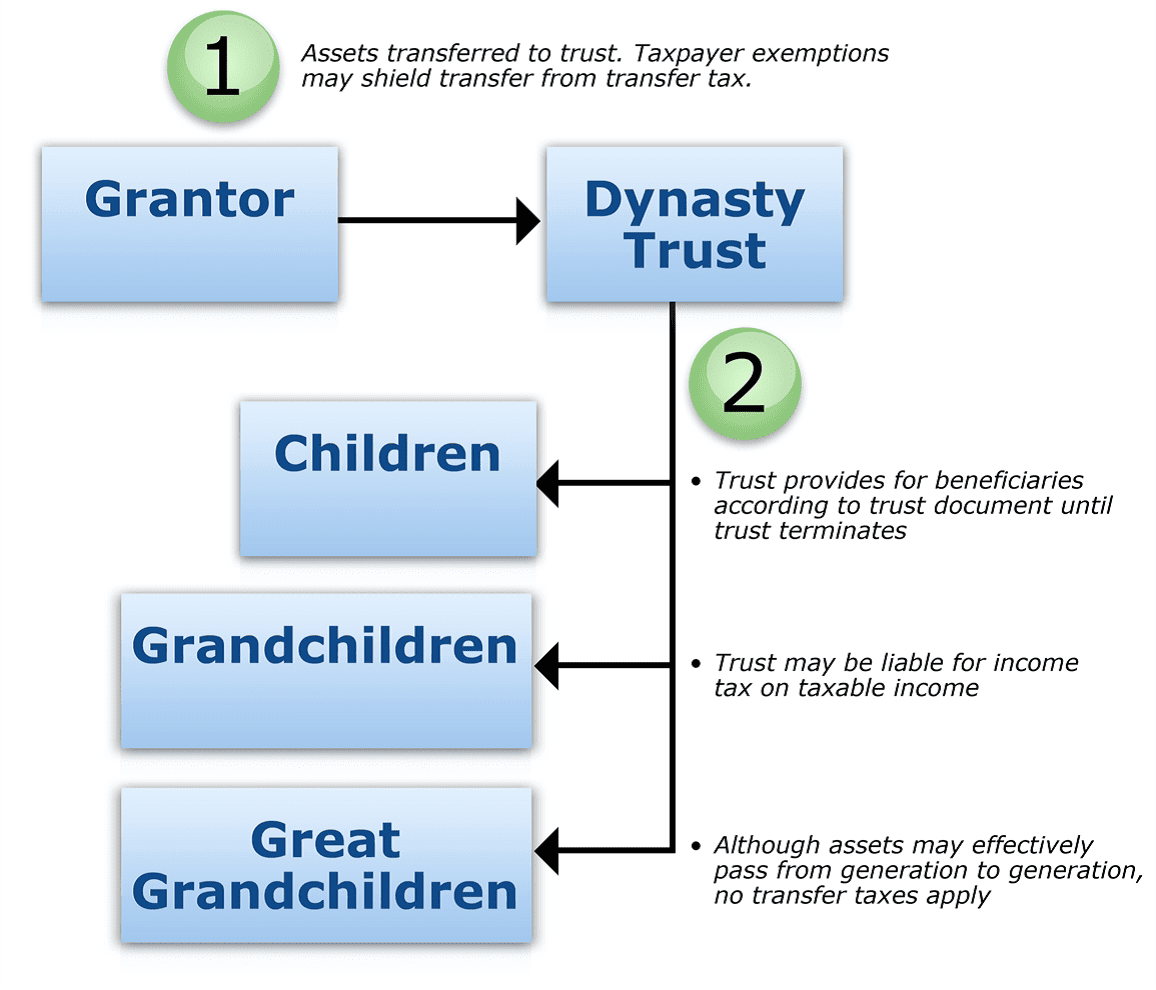

Is Your Legacy In A Dynast Trust Cwm

For example the sale of a 200000 home would require a 200 transfer tax to be paid.

. Kentucky has a 6 statewide sales tax rate but also has 226 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0008 on top. Motor Vehicle Property Tax Motor Vehicle Property Tax is an annual tax assessed on motor vehicles and motor boats. To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase.

The Kentucky State Tax Tables for 2019 displayed on this page are provided in support of the 2019 US Tax Calculator and the dedicated 2019 Kentucky State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. 310 Assessment of agricultural or horticultural land for inheritance tax purposes. 290 Refund of tax when debts are proved after deduction of tax.

Real estate in Kentucky is typically assessed through a mass appraisal. For most counties and cities in the Bluegrass State this is a percentage of taxpayers. A motor vehicle usage tax of six percent 6 is levied upon the retail price of vehicles registered for the first time in Kentucky.

If not the seller will be sent a notification by the Kentucky Revenue Cabinet of the tax due. If your boat was registered in Kentucky on January 1st of the current tax year you will be liable for the taxes under Kentucky law KRS 134810. This tax is collected upon the transfer of ownership or when a vehicle is offered for registration for the first time in Kentucky.

Local tax rates in Kentucky range from 600 making the sales tax range in Kentucky 600. Kentucky Transfer Tax Calculator Real Estate. To avoid delinquent tax it is recommended that the seller pay taxes at the time of transfer.

Please note that this is an estimated amount. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Kentucky local counties cities and special taxation districts. 1 As used in this section unless the context otherwise requires.

Kentucky Real Estate Transfer Taxes. Kentucky has one of the lowest median property tax rates in the United States with only seven states collecting a lower median property tax than Kentucky. The base state sales tax rate in Kentucky is 6.

If the sale or transfer occurred before January 1 of said tax year a copy of the new title or a copy of the bill of sale will be required in order to exonerate the tax assessment. Aside from state and federal taxes many Kentucky residents are subject to local taxes which are called occupational taxes. A Deed means any document instrument or writing other than a will and other than a lease or easement regardless of where made executed or.

Kentucky charges you about 010 of your homes sale price to transfer the title to the new owner. A county clerk cannot register or issue license tags to the owner of any vehicle unless the owner or his agent pays the Motor Vehicle Usage Tax in addition to the transfer registration and license fees. If the deed is a gift or indicates nominal consideration the tax is paid on the estimated price the property would bring in an open market.

In the case of new vehicles the retail price is the total consideration given The consideration is the total of the cash or amount financed and the value of any vehicle traded in or 90 of the manufacturers suggested retail price MSRP including. The tax rate is the same no matter what filing status you use. Actual amounts are subject to change based on tax rate changes.

All rates are per 100. The tax estimator above only includes a single 75 service fee. Kentucky sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

The median property tax on a 12940000 house is 93168 in Kentucky. The State of Delaware transfer tax rate is 250. It is levied at six percent and shall be paid on every motor vehicle used in.

Simply enter the costprice and the sales tax percentage and the KY sales tax calculator will calculate the tax and the final price. Usage Tax A six percent 6 motor vehicle usage tax is levied upon. To use our Kentucky Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

The transfer tax is imposed upon the grantor The tax is computed at the rate of 50 for each 500. For example the sale of a 200000 home would require a 200 transfer tax to be paid. If you sell for Kentuckys median home value 188000 youd pay 188.

142050 Real estate transfer tax -- Collection on recording -- Exemptions. Payment shall be made to the motor vehicle owners County Clerk. 320 Taxation of land converted from agricultural use.

Most counties also charge a county transfer tax rate of 150 for a combined transfer tax rate of 400. The KY sales tax calculator has the option to include tax in the gross price as well as the amount to be added to net price. The Kentucky Department of Revenue is responsible for publishing the.

300 Definitions for KRS 140310 to 140360. Our Kentucky Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Kentucky and across the entire United States. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Counties in Kentucky collect an average of 072 of a propertys assesed fair market value as property tax per year. Keep in mind a deed cannot be recorded unless the real estate transfer tax has been collected. The median property tax on a 12940000 house is 99638 in Mercer County.

Overview of Kentucky Taxes. All property that is not vacant is subject to a 911 service fee of 75 for each dwelling or unit on the property. Kentucky imposes a flat income tax of 5.

This calculator can only provide you with a rough estimate of your tax liabilities based on the property. 330 Land presumed assessed at agricultural value -- Procedure when not so assessed. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property.

Property taxes in Kentucky follow a one-year cycle beginning on Jan. Delaware DE Transfer Tax. Please note state sales tax rate might change and the default sales.

After a few seconds you will be provided with a full breakdown of the tax you are paying. When ownership in Kentucky is transferred an excise tax of 50 for each 500 of value or fraction thereof is levied on the value of the property. The median property tax in Kentucky is 84300 per year for a home worth the median value of 11780000.

Kentucky Property Tax Rules. Motor Vehicle Usage Tax Motor Vehicle Usage Tax is collected when a vehicle is transferred from one party to another. However your county or city may also charge their own transfer taxes.

Thats the assessment date for all property in the state so taxes are based on the value of the property as of Jan. Find your Kentucky combined state and local tax rate. Transfer tax is collected on the actual consideration paid or to be paid in the deed unless it is a gift.

1 of each year. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs.

Transfer Tax In San Diego County California Who Pays What

What You Should Know About Contra Costa County Transfer Tax

Transfer Tax In San Luis Obispo County California Who Pays What

Kentucky Real Estate Transfer Taxes An In Depth Guide

Irs Releases 2019 Instructions For Gift Tax Returns Henry Horne

Car Tax By State Usa Manual Car Sales Tax Calculator

Transfer Tax Alameda County California Who Pays What

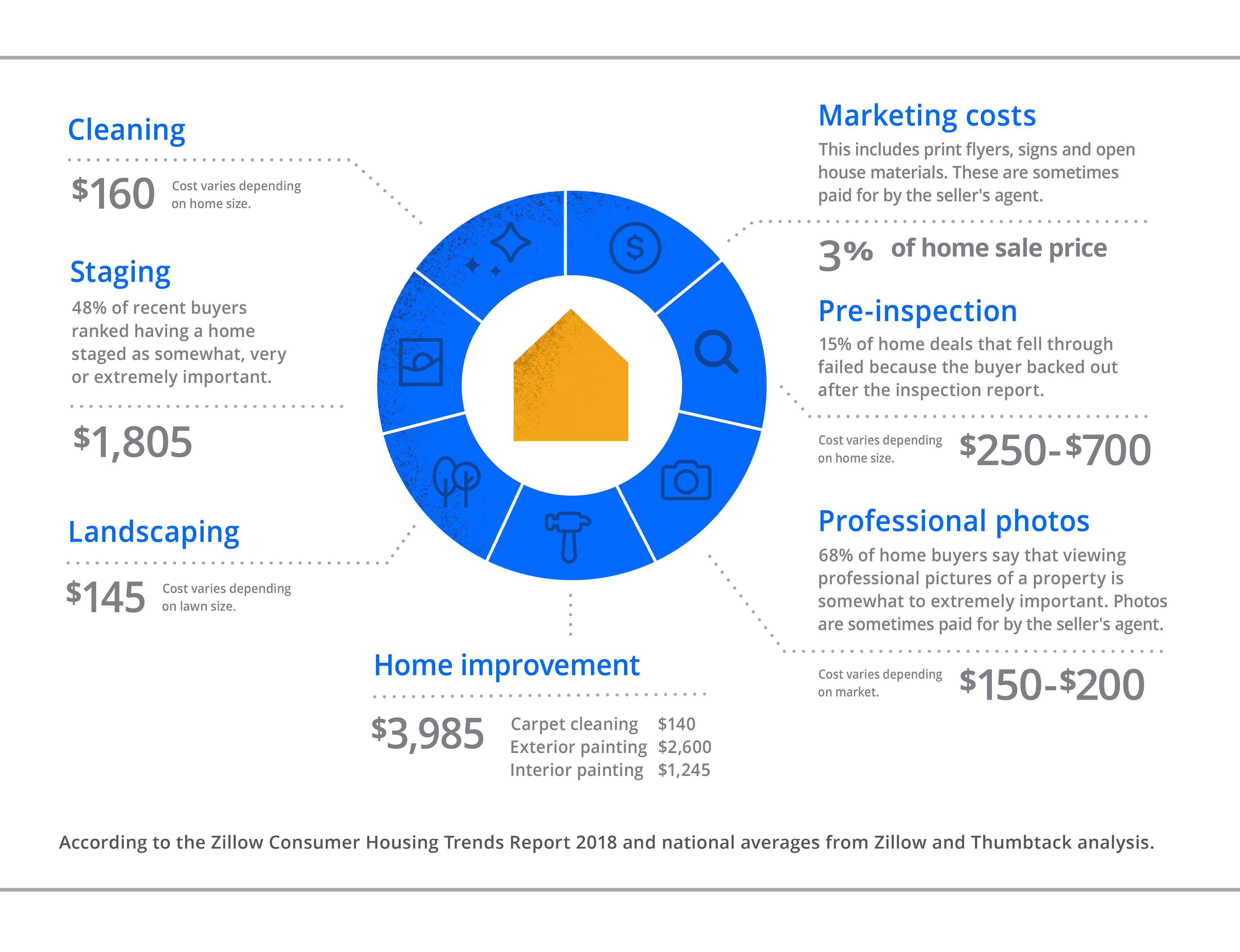

How Much Does It Cost To Sell A House Zillow

Rental Property Roi And Cap Rate Calculator And Comparison Etsy Rental Property Rental Property Management Income Property

Pin On Real Estate Escrow Services

Sales Tax Guide For Online Courses

Transfer Tax Calculator 2022 For All 50 States

/How-Is-the-Gift-Tax-Calculated-3505674-v2-HL-cf2d3bd9ac04413ba108e6b0a44f0f39.png)

Gift Tax How Much Is It And Who Pays It

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

The California Transfer Tax Who Pays What In Monterey County

Dmv Fees By State Usa Manual Car Registration Calculator

How Much Does It Cost To Sell A House Zillow

Tax Season 2022 When Can You File Taxes With Irs In 2022 Money